Ready to Start Adulting? Here’s A Guide to Understanding CPF in Singapore

There is no doubt that contributing to Singapore’s Central Provident Fund or CPF is extremely valuable, especially if you want to achieve financial stability in the future.

It is never too early to start planning for your retirement with your CPF. Unfortunately, CPF remains a confusing and heavy topic that many people do not understand.

With rules dictating how much of your monthly income should be contributed to the plan, different accounts involved, certain withdrawal rules, and various retirement schemes, it is easy to get overwhelmed.

In this guide, we will break down what CPF is so you can find out how you can leverage it to reach your financial goals.

Here at OMY Singapore, you will discover the following:

- What is CPF in Singapore? How does it Work?

- How do CPF contributions work?

- What are CPF contributions and allocations?

- What are CPF contribution caps?

- What is the CPF Annual Limit?

- What are 4 CPF accounts and their uses?

- What are CPF interest rates?

- When can you use the money in your CPF accounts?

- What is the CPF Retirement Sum and how does it affect you?

- What are the retirement payouts under CPF LIFE Scheme?

- How to make CPF nominations?

- What are the reliable CPF Calculators?

- How to contact CPF?

What is CPF in Singapore?

The Central Provident Fund is Singapore’s social security savings scheme funded by employees and employers.

CPF is controlled by the Central Provident Fund Board or CPFB, although CPF can refer to both the scheme, as well as the board that operates it.

CPF started in 1955 as a way of ensuring all Singaporeans would be financially stable after retirement. When it was first introduced, it was deemed controversial, and many opposed it. But over the years, it became more popular and well-accepted.

Over time, its purpose expanded from retirement alone to housing assistance in 1968, and healthcare in the 1980s.

In time, your CPF savings can help you pay for housing, education, and medical needs, as well as your retirement. This is important considering that 3 out of 10 Singaporeans between ages 30 and 39 have not started planning for their financial needs when they finally retire.

Considering this, CPF provides a solution for those who want peace of mind that they have set aside money for their retirement. With this, they are also lessening the country’s risk of depending on its working population to support elderly residents.

The major rationale behind this fund is that if people were not forced to contribute money to their CPF accounts, they would not have the means to pay for their medical bills or retirement needs.

Moreover, it also helps the homeownership rate in Singapore stay high since the CPF fund can be used to purchase homes.

How do CPF contributions in Singapore work?

CPF works through an automatic payroll deduction system, and it goes into effect for those earning more than S$50 per month.

Until you start earning S$500 per month, only the employer will contribute to the fund. For those earning more than S$500 per month, 5% to 20% of your salary must be contributed to the fund.

Generally, employers are required to withhold a percentage of their employees’ salary so it can go to their CPF accounts as their contribution. Aside from this, the employer also contributes to the account of employees out of their pocket, above the stipulated salaries of workers.

Since CPF is mandatory except for those working abroad, permanent residents and Singaporean citizens are required to start contributing money as soon as they land their first job, regardless of whether it is contractual, casual, or permanent.

For new Permanent Residents (PR), they must contribute to the CPF at graduated rates for 2 years to adjust to their lower take-home pay.

On the other hand, for those who are self-employed, only the MediSave contribution is mandatory (for those with an annual net trade income of more than S$6,000), but one can still contribute to all CPF accounts voluntarily.

People who contribute to the CPF can only start withdrawing from their retirement account at 55 years old. If one wishes to receive his money at a later date, it means there will be more money in the account.

CPF Contributions and Allocations in Singapore

The CPF contribution rate depends on the age bracket of workers, and it slowly decreases from 55 years old onwards.

It is important to note that other payments such as cash incentives, bonuses, and commissions also attract CPF contributions.

Take a look at the CPF contribution rates this 2022.

| Age | Contribution (Employer) | Contribution (Employee) | Total |

|---|---|---|---|

| 55 and younger | 17% | 20% | 37% |

| 55-60 | 14% | 14% | 28% |

| 60-65 | 10% | 8.5% | 18.5% |

| 65-70 | 8% | 6% | 14% |

| Above 70 | 7.5% | 5% | 12.5% |

It is important to note that over the next decade, the CPF contributions for older workers will be adjusted upwards to meet the full 37% contribution rate (both employee and employer.)

From January 2023 onwards, the CPF contribution rate for workers 60 to 65 years old will also be increased to 20.5%.

To illustrate how the CPF contribution works, let’s look at an example.

Person A is 35 years old and earning a monthly salary of S$5,000. Every month, Person A’s contribution to CPF is 20% of his salary. This means that S$1,000 will be deducted from his salary each month and automatically deposited into her CPF accounts. Therefore, his take-home pay is only S$4,000.

Aside from Person A’s contribution from his salary, his employer will also make a contribution that is 17% of his monthly salary – amounting to S$850. Overall, Person A’s CPF contribution totals S$1,850 per month.

CPF Contribution Caps

There is a limit as to how much people can contribute to their CPF accounts each month. This is called the CPF Wage Ceiling, which has two parts. The first is the Ordinary Wage Ceiling, and the second one is the Additional Wage Ceiling.

Ordinary Wage Ceiling refers to the contribution cap on one’s monthly salary, which is S$6,000. The first S$6,000 salary is considered for CPF contributions. It also means that employers do not need to worry about contributing more money to one’s CPF above the said amount.

Considering this, if Person A has a S$6,000 monthly salary, and Person B has an S$8,000 monthly salary, they can be contributing the same money to their CPF.

Meanwhile, an Additional Wage Ceiling is a contribution cap that refers to your additional wages, such as bonuses. To calculate this, subtract S$102,000 from the ordinary wages subject to CPF.

For instance, if Person C receives an annual bonus of S$25,000, this is how the Additional Wage Ceiling will be computed:

S$102,000 – S$6,000 x 12 = S$30,000

Therefore, Person C’s full annual bonus will be subjected to CPF contributions.

The 4 CPF Accounts and Their Uses

CPF contributions by Singaporeans and Permanent residents are divided into four accounts.

| CPF account | Purpose |

|---|---|

| Ordinary Account (OA) | Housing, investing, higher education (Leftover will be for retirement) |

| Special Account (SA) | Retirement and investment (to a certain degree) |

| MediSave account (MA) | Hospitalisation, approved medical expenses, MediShield/Integrated Shield Plans |

| Retirement Account (RA) | Only applicable to workers 55 years old and above The Ordinary Account and Savings Account will merge to form this account which contains retirement savings |

Moreover, it is crucial to understand the allocation of your CPF contributions to your different accounts.

| Age | Ordinary account (Percentage of wage) | Special account (Percentage of wage) | MediSave (Percentage of wage) |

|---|---|---|---|

| 35 and below | 23% | 6% | 8% |

| 35-45 | 21% | 7% | 9% |

| 45-50 | 19% | 8% | 10% |

| 50-55 | 15% | 11.5% | 10.5% |

| 55-60 | 12% | 5.5% | 10.5% |

| 60-65 | 3.5% | 4.5% | 10.5% |

| 65-70 | 1% | 2.5% | 10.5% |

| Above 70 | 1% | 1% | 10.5% |

For younger workers, the CPF prioritises funds going into Ordinary Account, and less money will go into the MediSave account. This is because workers are more likely to buy a house while they are still young.

After workers turn 55, the OA and SA contribution rate will decrease to make way for MediSave. During this time, it is assumed that you have saved enough for retirement.

CPF Interest Rates

Your CPF contribution will be invested in Special Singapore Government Securities to ensure that your money is safe from market fluctuations. You can earn interest on all the funds in your OA, SA, MA, and RA. Take a look at the interest rates for 1 April 2022 to 30 June 2022.

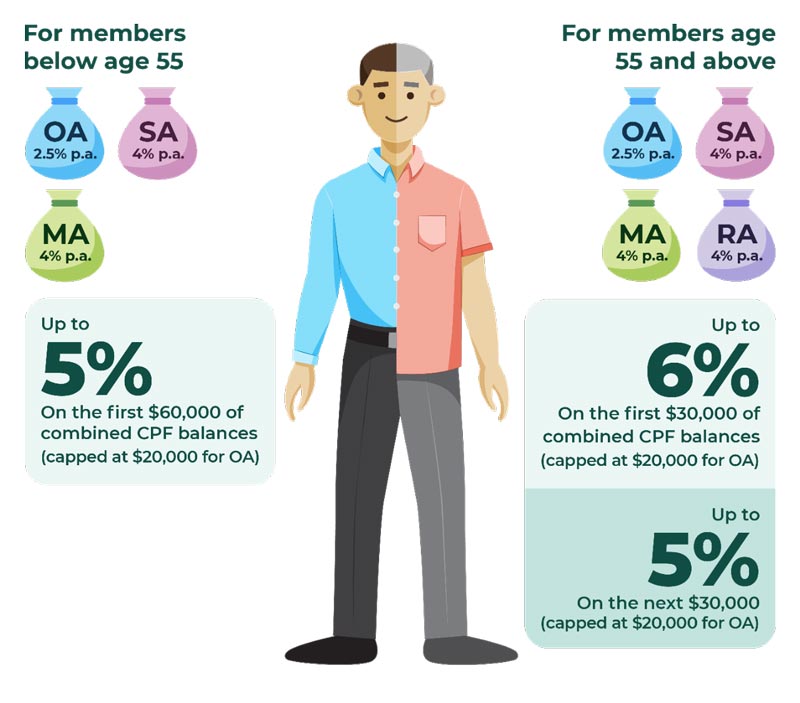

For Members Below 55 Years Old

| Account | Interest per annum |

|---|---|

| Ordinary account | Up to 2.5% |

| Savings account | Up to 4% |

| MediSave Account | Up to 4% |

Members below 55 years old can earn up to 5% per annum on their CPF Savings for the first $S60,000 of combined CPF balances (capped at S$20,000 for OA).

For Members 55 Years Old and Above

| Account | Interest per annum |

|---|---|

| Ordinary account | Up to 2.5% |

| Savings account | Up to 4% |

| MediSave Account | Up to 4% |

| Retirement account | Up to 4% |

On the other hand, members 55 years old and above can earn up to 6% per annum on their CPF savings for the first $S30,000 of combined CPF balances (capped at S$20,000 for OA). Moreover, they can earn up to 5% per annum on your CPF savings for the next S$30,000 (capped at S$20,000 for OA).

Looking at the table above, you can observe that the Savings account offers a better interest rate compared to OA. While you can transfer your funds from OA to SA, the downside is that you cannot transfer money back from SA to OA.

Therefore, you will not be able to use the money to pay for housing, or education, which is the main purpose of OA.

If you want to take your money from OA to SA, make sure that you do not need the money in the near future.

In Summary, here are the Current CPF Interest Rates:

Image Source: Central Provident Fund Board

When Can You Use the Money in Your CPF Accounts?

You can use the money in your CPF account in many ways.

For example, you can buy or build a private or residential property or buy a flat from the Housing & Development Board.

In addition, it can be used for the down payment and housing loans, as well as stamp and legal fees, loans for construction, and to purchase vacant land for private properties. Your OA can also be used to purchase Home Protection Scheme premiums for Housing & Development Board flats.

However, there are limits to the amount of money in your Ordinary Account that you can use for this purpose.

Furthermore, it is recommended to set aside some money in your OA savings. This can be used as an emergency fund, and for retirement.

Additionally, your OA savings can be used to pay for education, whether it is for you, your children, or your spouse. Moreover, it is possible to use your OA savings to help your relatives, although justification is required.

Keep in mind that whether you plan to use your OA for housing or education, you must put it back depending on certain conditions.

For example, one of the major repayments you must make is if you sell your home that was paid using your CPF. Upon the sale of the property, you must pay back the amount you withdrew, as well as the interest you would have earned if the money wants to be kept in your account.

Once this has been returned to your OA, you can withdraw cash once more.

For education, you must pay back the principal sum you took out, as well as the interest. The payment will start one year after the student leaves the university or institution, and the person who used the fund for education is responsible to handle the repayment.

When it comes to your retirement fund, you can only start withdrawing at a lump sum when you are 55 years old.

What is the CPF Retirement Sum and how does it affect you?

The CPF Retirement Sum Scheme requires people to have a minimum amount in their CPF accounts during retirement. This will ensure that a monthly payout can be received to support one’s standard of living.

How much money you’ll get each month will depend on how much is in your RA. When your RA balance is depleted, you will not get monthly payouts to support your basic standard of living.

What Are the Retirement Payouts Under CPF LIFE Scheme?

The CPF Lifelong Income for the Elderly or CPF LIFE is a scheme that will give monthly payouts to people for as long as they live. Therefore, there is no need to worry about outliving your savings, as long as you can accumulate enough money before starting your monthly payout.

To get on this scheme, you need to meet a requirement sum which will determine how much your monthly payout will be.

Every year, the number of retirement sums that need to be met increases because of the rising cost of living. The amount also depends on whether you want to choose a basic retirement sum, full retirement sum, or enhanced retirement sum.

How To Make CPF Nominations

You spent your whole working life contributing money to your CPF, but what will happen if you pass away? Will you be able to will it to your loved ones?

The answer is NO. The money in your CPF accounts cannot be distributed through a will. However, you can specify who wants to receive your CPF savings through the CPF Nomination Scheme.

Aside from deciding who will receive your savings, you will also decide how much money they will be receiving.

Making a nomination easy. Simply submit a form with the documents required at a CPF Service Centre, or by post. If you were not able to make a nomination, your CPF savings will be distributed to your next kin by the Public Trustee’s Office.

However, a fee will be deducted to cover the administrative work.

CPF Calculators

To help you get an idea of how much money you can receive or use in the future, there are tons of free and reliable CPF calculators you can use.

You can use this calculator to check how much your contributions need to be.

CPF Housing Withdrawal Limits Calculator

Want to buy a home? Here is a calculator you can use to find out how much money you can withdraw to cover this expense.

Are you on track to fund the standard of living you want to maintain when you retire? Use this calculator to know the answer.

If you are over 40 years old, you can use this calculator to estimate how much money you can receive during your monthly retirement payout

MediSave Contribution Calculator

Are you self-employed? If so, you can use this calculator to check how much you need to contribute to your MediSave.

How to Contact CPF

CPF has made it easy for you to reach them if you have any problems or queries. Here is how you can get in touch with CPF.

Log in to CPF Online Services Portal using your Singpass. Here, you can easily access information about your account, such as your balance. For queries, simply submit via the “My Mailbox” feature. You can also submit a web form.

Call them

From Monday to Friday, 8 AM to 5:30 PM, you can call CPF on their hotline, 1800-227-1188. If you are calling from overseas, dial +65-6227-1188.

Visit CPF Service Centres

Simply make an appointment if you want to visit any CPF Service Centres located in Maxwell Road, Bishan Place, Jurong Gateway Road, Tampines Central, and Woodlands Drive (closed for renovation until September 2022).

A Word from OMY

Every month, a portion of your salary goes to the Central Provident Fund. Therefore, it is crucial to understand what it is and how it can impact your future. The goal of CPF boils down to one thing – helping people achieve financial stability.

Think of it this way – when you contribute to the CPF, it is like splitting your money between your current and older self.

Now that you finally understand the ins and outs of CPF, you can save more money for your future, and invest with confidence.