Your Guide To The Most User-Friendly And Reliable Online Brokerages In Singapore 2022

Do you think making money is hard? You’re not alone. Despite this, you must still hustle to save, earn, and grow your money. If you want to diversify your investment portfolio, this is where the best online brokerages in Singapore come into play.

One of the most common questions investors have in Singapore is this: what are the best online brokers in the country? Individuals who are new to the stock market, as well as veteran traders, must know the answer so they can be with a firm that offers the best service possible.

However, the answer is not the same for everyone.

Finding the ultimate online brokerage depends on what service you want to prioritise. Do you want the biggest returns? Do you prefer an online broker with a low minimum investment? Or do you want to trade on the go? Or maybe you choose an online brokerage with tons of perks and market insights?

If you want to determine the best choice for you, keep on reading.

Here at OMY, you will discover the following:

What Is An Online Stock Broker?

The term “online brokerage” can sound a bit technical to beginners. However, you don’t have to be a financial expert to understand what this means.

Basically, online brokers are trading companies that operate in the virtual world. These brokages allow you to set up an account easily so you can make trades via the internet, whether it’s through your computer or smartphone.

Thanks to online brokerages, you can trade on the go rather than take time to visit brokerage branch offices to buy or sell stocks.

More From OMY: How To Invest In Singapore: A Beginner’s Guide

Factors To Consider When Choosing The Best Online Brokerages In Singapore

There are many factors to consider when choosing the best online brokers in Singapore. This is because different brokers are good at different things.

Commission Fee

Just like traditional brokerage firms, online firms also charge a commission for each transaction you make on the stock market. This includes buying or selling shares.

Usually, there are two parts of commissions. The first one is the fee itself or a percentage of the transaction. The second one is the minimum fee.

For example, if you’re buying S$5,000 worth of shares, the brokerage may charge a 0.1% commission with a minimum of S$10, so you’ll end up paying S$10 instead of S$5. If you sell these shares, you’ll pay another S$10 once more.

If your stock market strategy is a parking lump sum for a long time, then these fees may not affect you so much. However, if you invest regularly, you will end up paying a lot of commission fees. If you plan on doing this, make sure to factor in the commission fees to save money.

Account Type

The next thing you have to consider is the “Stock Holding Type,” which is the account brokerages use for holding stocks. This can either be a custodian or CDP account.

A custodian account is when the brokerage owns the stocks on behalf of their customers. Therefore, it’s not technically in your name. Although this may sound risky, it is regulated by MAS. Most firms have this type of account.

Meanwhile, a CDP account holds stocks under your name in your personal CDP account. Considering this, you will have full rights to your shares, such as attending annual general meetings. If your brokerage firm of choice goes bankrupt, your shares will not be lost.

Customer Support

A good brokerage will not only have a solid trading platform and efficient services, but it should also provide you with excellent customer support. Make sure that you can get in touch with the customer support team whenever you have questions regarding stock trading. The company should be able to answer all your queries.

Part of customer support is investment insights. Your brokerage firm of choice must be able to provide insights to investors like you on when to buy, sell, or call stocks. They must also regularly publish research reports, market outlooks, and stock ideas. And other deliverables for customers to use.

Perks

You may also consider the perks provided by brokerages from time to time. This can be waived commission fees, vouchers, rebates, or low commissions. Leverage these perks by making more trades during the promotion period.

Best Online Brokerages In Singapore

Here are our top choices for the best online brokerages in the country. Don’t have time to examine each best online trading platforms? Take a look at this table below to compare them side by side.

| Online brokerage | Major markets | Commission fee | Highlights |

|---|---|---|---|

| SAXO Markets | Singapore, US, Japan, HK, EU |

|

|

| Tiger Brokers | Singapore, US, HK, China, Australia |

|

|

| Moomoo | US, Singapore, HK |

|

|

| TD Ameritrade | US only |

|

|

| FSMOne | Singapore, US, HK, Malaysia, China A Shares |

|

|

| Interactive Brokers | Singapore, US, Hong Kong, Japan, among many others |

|

|

Best Trading Platform For Beginners: SAXO Markets

| Market | Bronze | Silver | Gold | Platinum | Diamond | Minimum fee |

|---|---|---|---|---|---|---|

| Singapore | 0.08% | 0.06% | 0.05% | 0.04% | 0.22% | S$5 |

| US | 0.06% | 0.04% | 0.03% | 0.025% | 0.27% | $3-$4 |

| Japan | 0.15% | 0.15% | 0.15% | 0.10% | 0.32% | JPY1,000 to JPY1,500 |

| Hong Kong | 0.15% | 0.15% | 0.15% | 0.12% | 0.21% | HKD60-HKD90 |

| Europe | 0.10%-0.30% | 0.10%-0.30% | 0.10%-0.30% | 0.07%-0.25% | 0.31% | EUR6-EUR20 |

This best stock trading platform is an excellent choice for investors who want to prioritise market access and low cost. Although it’s not the best for individuals who want to exclusively invest in international markets, it’s still a standout. One of the best perks of SAXO markets is that the fees for higher-tier plans can be waived using points. They also offer SAXOTraderGo, one of the best stock market app in Singapore.

The commissions of this trading platform are generally lower compared to its competitors. At only 0.08% commission with a minimum of S$5, it should be a top choice of traders. This platform also doesn’t charge a monthly minimum commission, unlike other brokers that offer low costs. This feature makes it great for long-term investors who invest S$100,000 or less.

It’s also an established platform so it offers an amazing user experience thanks to its intuitive platform interface.

SAXO Markets offers different account plans namely Bronze, Silver, Gold, Platinum, and Diamond. Its bronze plan is free of charge, and the higher plans offer package bundles in exchange for a small monthly fee. The perks include low commission rates, no custody fees for those who opt into Securities Lending, as well as free commission credits, and live prices on different exchanges.

Best For Global Markets: Tiger Brokers

| Market | Fee | Minimum Commission |

|---|---|---|

| Singapore | 0.06% | S$1.99 |

| US | $0.01 per share | $1.99 per order |

| Hong Kong | 0.06% | HKD15 |

| China | 0.06% | RMB15 |

| Australia | 0.1% | AUD8 |

| Futures | $0.99-$4.50 |

Although Tiger Brokers is a new player in the industry, it has cemented its name as one of the top online brokerages in Singapore. Since 2020, this brokerage has accounted for three-fold growth and a whopping 540% increase in its trading value.

With its low-cost trading fees and minimum commission of only S$1.99, it overtakes the industry leader, SAXO Markets. This brokerage also offers a comprehensive online trading platform with live prices for US and Singapore, plus access to major markets globally. Considering this, Tiger Brokers is a brokerage you should think about joining.

Its platform also offers real-time quotes for SGX, NASDAQ, HKEX, and NYSE, and fantastic 24/7 multilingual customer service. You’ll also love its useful app which is designed for both new and seasoned investors.

If you want to specifically trade for Hong Kong markets, Tiger Brokers offers a very affordable commission. You can also choose between a cash account or a margin account. Tiger Brokers do not charge any custody fees, currency exchange fees, inactivity fees, account maintenance fees, and even deposit and withdrawal fees.

Best Perks: Moomoo By FUTU

| Market | Commission | Minimum Fees |

|---|---|---|

| US | Free | $0.99 per order thereafter |

| Singapore | 90-day commission free for each friend invited, 0.03% for unqualified | $0.99 per order thereafter |

| Hong Kong | 90-day commission free for each friend invited, 0.03% for unqualified or HK$3, whichever is higher | HK$15 per order |

This is the only brokerage firm in the country with a S$0 platform fee, and lifetime free commission for US stocks. They also offer no fees on US, SG, and HK markets for a limited time. So if your priority is to save, what’s not to like about it?

Upon opening an account, you can also access Level 2 market data for the US stock market, level 1 market data for the Singapore stock market, and China A shares market for free.

Except for their commission-free months, MooMoo only charges a 0.03% commission fee, with a $0.99 minimum.

MooMoo powered by FUTU is the pioneering online brokerage firm in the country that offers tons of freebies for US stocks. With their low commission fees in the market, as well as seamless access to Singapore, US, and Hong Kong financial products, it’s worth considering.

MooMoo also does not have a minimum initial deposit, which makes it an amazing option for newbie traders.

Best For US Markets: TD Ameritrade

| Market | Commission fee | Minimum fees |

|---|---|---|

| US | $0 | $0 |

This is another popular online brokerage firm in Singapore that offers an amazing platform, as well as low fees. This platform does not have a platform fee, inactivity fee, and minimum deposit required to start trading.

Whatever your investment needs are, especially if you are only interested in trading in the US market, you’ll love TD Ameritrade. Considering this, it’s one of the best choices for individuals who want to diversify their stock portfolio through international stocks.

When it comes to the platform, TD Ameritrade offers its customers access to the latest market information. It is also very easy to navigate so it’s recommended for beginners. Despite this, everyone can still leverage advanced features, especially seasoned traders. They also offer investor education and trading tools.

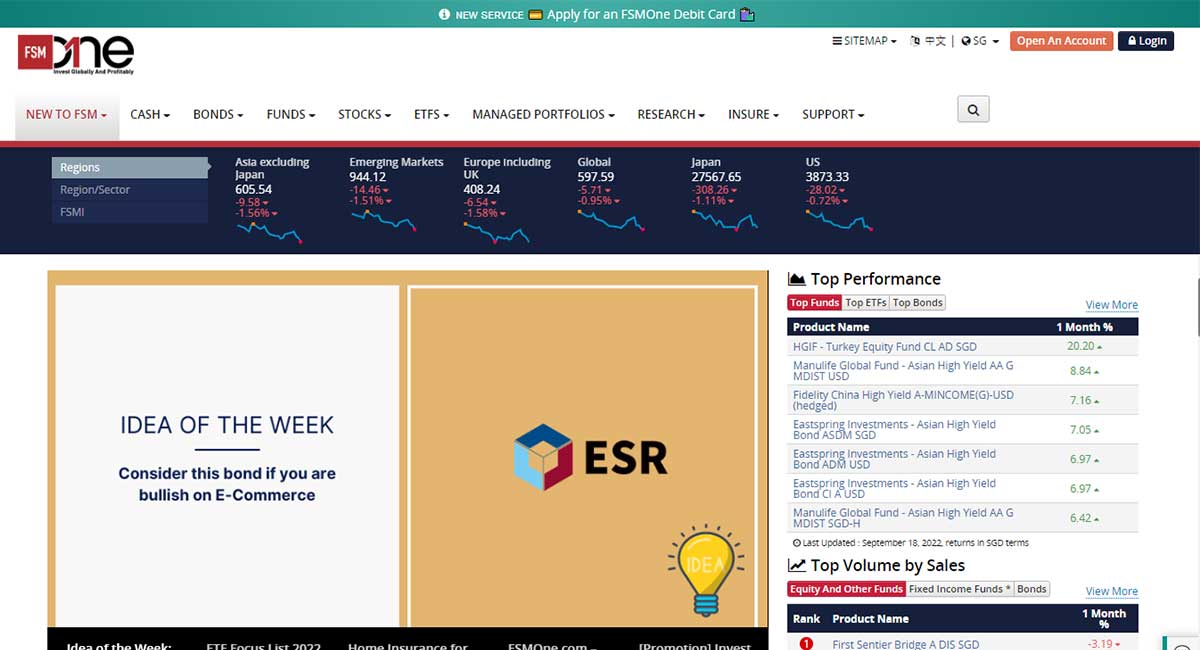

Best For International Market Flat Fees: Fsmone

| Market | Commission fee | Minimum Amoun |

|---|---|---|

| Singapore | S$8.80 | S$8.80 |

| US | 0.08% | $8.80 |

| Hong Kong | 0.08% | HKD50 |

| Malaysia | 0.08% | MYR8.80 |

| China A Shares | 0.08% | CNH40 |

With their low international trading fees and notable rewards programme, it’s no wonder why FSMOne is preferred by many traders in Singapore. Aside from its low fees, FSMOne Prestige Privileges offers rewards for investors who put in large amounts of money on their portfolio, particularly S$200,00 or more.

Their Standard, Gold, and Diamond account holders can also get points for each transaction they made, as well as redeem vouchers, gain access to exclusive events, donations for charity, discounts on investment products and estate planning services, and even dining vouchers.

FSMOne offers one of the best brokerage accounts in Singapore. It is a must-consider for investors who want to invest in the international market, but want to save on lower-than-average fees, especially in Hong Kong, Malaysia, the US, and China. This is because this brokerage only charges 0.08% commission for trades.

It’s not the most affordable brokerage in the market when it comes to investing in local stocks and its flat fee of S8.80 can be a deal-breaker for investors who want to focus on SG stock. They also carry annual and quarterly fees, which is something investors should consider.

Best For Market Access: Interactive Brokers

| Market | Commission fee | Minimum Amoun |

|---|---|---|

| SG | 0.08% | S$2.50 |

| US | $0.005 per share | $1 |

| Hong Kong | 0.08% | HKD18 |

| Japan | 0.08% | JPY80 |

While you may be better off with another brokerage if you want to solely focus on the local market, Interactive Brokers is an awesome platform for investors who want to explore international market access since it allows customers to invest in 26 international markets. Along with this perk also comes low commission fees for international trading, as well as premium pricing for high-volume traders.

Compared to other online brokerages, you’ll be able to trade more products in this best trading platform. They offer different types of accounts depending on whether you prefer to individually invest or jointly invest. Their Individual Account allows customers to trade cash, securities, and even portfolio margins. This platform also gives you access to tools like futures, currencies, funds, bonds, trade stocks, and more. One great perk of this platform is they pass savings directly back to their customers for exchanges that provide a rebate.

More From OMY: Singapore Savings Bonds: Complete Guide to Buying SSB

Frequently Asked Questions

Have some questions about the best online brokerages in Singapore? We’ll answer them below.

What online broker is best for beginners in Singapore?

With its low cost and easy user interface, SAXO Markets stand out as one of the best online brokerages in the country. Despite this, you should still take into consideration your investment strategy before choosing a platform. For example, if you solely want to focus on free market data for educational purposes, then consider MooMoo.

Which is the cheapest brokerage in Singapore?

This depends on the market you want to trade. If you want to focus on US Markets, TD Ameritrade is the brokerage to go. For both local and international markets, consider Tiger Brokers, Moomoo, and SAXO Markets.

What is the recommended amount of money to start with when it comes to trading?

It is recommended to start with at least S$3,500.

Is Moomoo regulated by MAS?

Yes. Just like other online brokerages, Moomoo is regulated by the Monetary Authority of Singapore or MAS. This means they comply with MAS requirements.

Can brokers steal your money?

Absolutely not, so there is no need to be afraid. Online brokerages cannot steal your stocks or money just as your bank cannot steal what’s in your account.

How much money do you need to open a brokerage account?

Tiger Brokers, Moomoo, and TD Ameritrade do not require a minimum deposit. This means you can start your stock market investing journey no matter how much money you have.

How old do you have to be to open a brokerage account?

You have to be at least 18 years old.

More From OMY: How To Invest Gold In Singapore For Beginners?