SG tax revenue grows by S$11.1 billion

Tax collection in Singapore increased by a whopping S$11.1 billion in the latest financial year, which marked a 22.4% rise compared with the previous year.

According to the Inland Revenue Authority of Singapore (IRAS), the S$60.7 billion total tax revenue collected represented 11.4% of the country’s gross domestic product, and 73.6% of the government’s operating revenue.

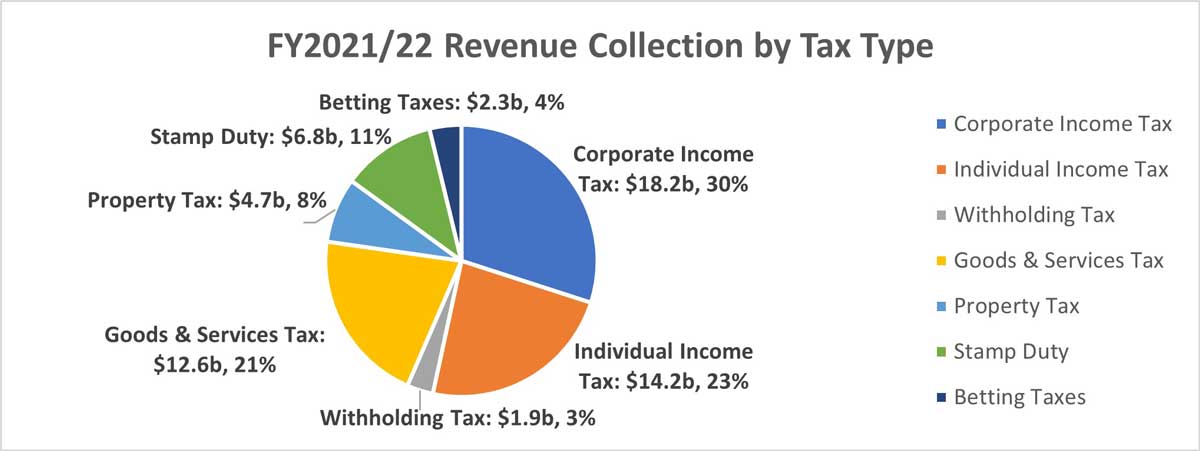

Of the collected tax, the biggest contributor was corporate tax at S$18.2 billion. This was followed by individual income tax at S$14.2 billion. Around 80% of the said taxes were from taxpayers with an annual income above S$150,000.

Meanwhile, a total of S$12.6 billion and S$6.8 billion were collected from goods and services, and stamp duty, respectively.

Compared to the last financial year, the biggest increase came from stamp duty at S$2.9 billion. This collection grew by an average of 8.4% over a five-year period.

More from OMY: Singapore maintains 3% to 5% 2022 growth forecast

Image Source: Inland Revenue Authority of Singapore

The second biggest increase came from goods and services tax at S$2.3 billion. This can be attributed to more active consumer consumption as COVID-19 restrictions were finally eased.

Meanwhile, the number of taxpayers that required assisted services significantly reduced to 22.7%, and self-help transactions decreased by 8%.

According to the statutory board, they are exploring more ways to improve everyone’s audit experience through better transparency.

See the full report here.