YouTrip Card 101

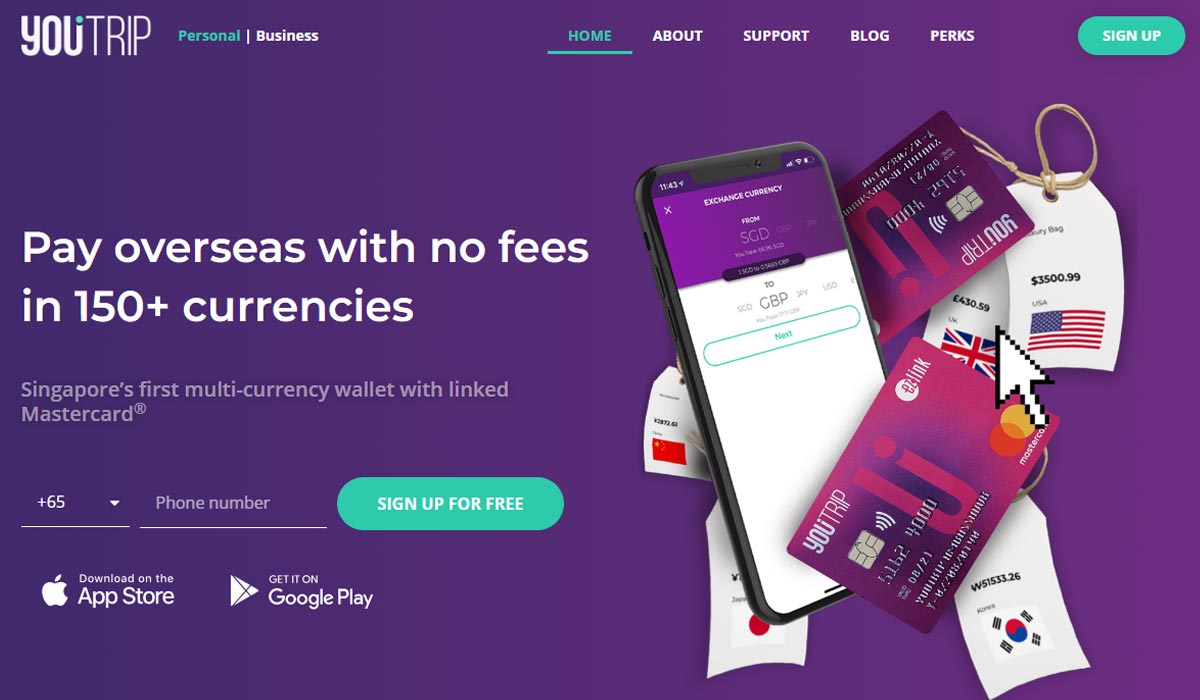

These days, convenience and savings should be your top priorities. Thanks to YouTrip, this is possible. A YouTrip card is the ultimate thing to have for people who love to shop or travel abroad. This card is linked to a digital wallet that allows you to store over 150 currencies without any conversion fees.

A YouTrip card is the perfect companion to your retail therapy and travels. It’s definitely one of the best ways to pay cashless since you can enjoy competitive exchange rates and no transaction fees. Without worrying about these things, you can maximise your money’s value.

If you want to know more about YouTrip, keep on reading.

Here at OMY Singapore, you will discover the following:

What Is YouTrip?

YouTrip Singapore comes with two components. First is the mobile wallet, where you need to make top-ups with a debit or credit card before you can use it. This component also has a S$5,000 limit of money it can hold, as well as an annual limit of S$30,000.

This guide will focus more on the physical YouTrip card, which lets you make contactless payments through Mastercard. Your card can easily be managed in your mobile wallet. Your card is free upon sign-up, and it has no annual or registration fees. Expect to receive your card two weeks after signing up for YouTrip.

So how does YouTrip work? With your YouTrip card, you can pay in over 150 currencies without worrying about fees. The foreign currency conversion will be done at the time of your purchase. Not only that, but YouTrip also lets you monitor, exchange (from SGD), and store various currencies, namely:

- SGD

- USD

- HKD

- EUR

- GBP

- CHF

- NZD

- SEK

- JPY

These conversions will not incur any additional fees.

How to Use YouTrip Card

Wondering how to use YouTrip overseas and locally? It’s so easy. You may also use your YouTrip card Singapore to withdraw cash at Mastercard, Cirrus, or Maestro ATMs overseas at wholesale exchange rates. All you need to pay is the $5 YouTrip withdrawal fee or the foreign currency equivalent of the transaction.

Not only that but this UTrip card is accepted by over 30 million merchants around the world. This does not just include physical stores, but also e-commerce stores.

That said, if you’re wondering how to use YouTrip in Malaysia, all you need to do is to convert to the country’s currency and you’re all set. The same is true for YouTrip Japan, YouTrip Thailand, and other countries.

YouTrip Perks

YouTrip will instantly notify you on your YouTrip app for any transactions made. This way, you’ll never miss out on any expenses and you’ll be alerted immediately if there are any fraudulent or wrong transactions.

Not only that, but you can also easily access your transactions without scrolling for ages. The next time you want to see a specific transaction, just click the search icon and type the merchant name, currency code, amount, location, or date.

If you lose your YouTrip card, you can lock it on your app. You may also unlock it in-app if needed. YouTrip cards also come with 3D Secure, which is a verification step that ensures security.

Why Choose YouTrip?

Did you know that most credit cards in Singapore charge 2.8% to 3.5% in admin fees for every foreign currency transaction? This may seem like a small amount but it can easily add up. With a normal credit card, you also have to worry about hefty exchange rates.

Thankfully, that’s not a problem with a YouTrip card. With this card, you can say farewell to hidden bank fees since it has 0% processing and admin fees for foreign currencies, and 0% markup on wholesale exchange rates.

How to Sign Up for a YouTrip Account

It’s so easy to sign up for a YouTrip Account. Here’s a step-by-step guide on how you can do it.

- Download the app on App Store or Google Play.

Note: Singpass users can sign up with MyInfo. This can help you save time on keying in personal information. If you don’t want to sign up with MyInfo, follow the next steps. - Once the app has been downloaded, click “sign up for free.”

- Submit the necessary documents. For Singaporeans and PRs, prepare your NRIC. For foreigners living in Singapore, prepare a Singapore-issued ID and proof of address, such as your phone or utility bill. Take a photo of these documents, both front and back.

- Enter your preferred name on your card.

- Enter other personal information, including your residential address. Make sure to match the details on your ID for faster verification.

- Wait for 1 to 2 working days for YouTrip to verify your information. Once you receive your card, simply follow the instructions on the app to activate it. Finally, you can start enjoying YouTrip.

How Can You Top Up with YouTrip

Here’s how you can top-up your YouTrip card in under 3 minutes.

YouTrip Top Up Using PayNow

With PayNow, you can easily top-up your wallet through your mobile banking app. PayNow is a service that allows clients of nine participating banks in Singapore to receive or send money to and from other parties through a linked bank account. This includes:

- POSB/DBS

- Standard Chartered

- OCBC

- UOB

- Citibank

- Maybank

- HSBC

- Industrial and Commercial Bank of China Limited

- Bank of China

More From OMY: The Best Buy Now Pay Later (BNPL) Service in Singapore

PayNow top-ups are the best option for those who don’t have a debit or credit card and don’t want to link their card details. Through PayNow, you don’t need to input your bank or card details since you only need to make the transfer on your mobile banking app. The minimum top-up is S$1 which makes it amazing for small purchases. To top up your Youcard with PayNow, follow these steps:

- Press Top-Up And Select PayNow. Wait for a panel to appear with the PayNow option. You may also top the drop-down arrow.

- Enter the amount you want to top up and save the QR code. The code will only be valid for 5 minutes.

- Launch the PayNow QR scanner on your bank app and scan the code.

- Verify your top-up details. The payee name should be “You Technologies Group (SG).”

- Finally, you can see your money on your U Trip card.

YouTrip Top Up Using Credit Card

It’s so easy to top-up your YouTrip card with credit card or debit card. Here’s how you can do it.

- Select Top-Up on your YouTrip app.

- Select the drop-down arrow. Then, add your card information.

- Enter your card information. Only Visa and Mastercard credit cards are accepted to fund your account. YouTrip amex is still not available.

Note: Starting on 20 December 2021, there will be a 1.5% service fee on top-ups made with Visa cards. Visa debit card users are not subjected to this fee. - Go through with the verification required by your card issuing bank if this is your first time topping up with your credit or debit card. This helps prevent fraud.

Is YouTrip a Credit Card?

No. Your YouTrip card is a prepaid Mastercard.

A Word From OMY

YouTrip’s convenience and affordability are truly unmatched. If you want to take advantage of YouTrip, simply download the app, sign up for an account, top-up money in your card and wallet, and you’re all set. Once you start using your YouTrip card, you can say goodbye to expensive conversion and admin fees.

More From OMY: Ultimate Guide to Best Digital Multi-Currency Accounts in Singapore