Want to Invest in Singapore Savings Bonds? This Detailed Guide Is for You

Since you were a child, you’ve been taught the importance of saving money in your piggy bank, but as you grow up, where should you put your savings?

If you ask your friends, family, and colleagues where they put their savings, most of them will answer banks. Banks are a safe and reliable place to store your savings, whether they’re for your future expenses or emergency fund.

Unfortunately, banks are not the best place to store your money if you want it to grow. With very low-interest rates that are less than 1%, your S$1,000 savings will only get you enough money to buy a litre of petrol.

But what if we tell you that there’s a smarter way to keep your money and help you earn even while you sleep? This is where the Singapore Savings Bonds (SSBs) come into play. In this article, we will help you understand everything you need to know about this helpful investment instrument.

Here at OMY Singapore, you will discover the following:

- What Are Savings Bonds?

- How Are Singapore Savings Bonds Different from Singapore Government Securities?

- Fixed Deposits: Alternative to Singapore Savings Bond

- Why Should You Consider Investing in Singapore Savings Bond?

- Disadvantages of Investing in SSBs

- Who Should Invest in SSBs?

- How to Buy Singapore Savings Bonds

- How to Redeem Your SSBs

- Allotment for Oversubscribed Issues

What Are Singapore Savings Bonds?

Savings Bonds are types of Singapore Government Securities with features that make them an amazing option for investors. This is fully backed by the government, and it is popular with Singaporeans, PRs, and foreigners because it usually offers a higher return on investments compared to banks.

The Monetary Authority of Singapore publishes new bonds each month, with varying interests. To give you a clearer picture of Singapore Savings Bonds, let’s take a look at SBFEB23 GX23020X. Its average return over 10 years is 2.97%.

| Year from issue date | Interest % | Average return per year %* |

|---|---|---|

| 1 | 2.84 | 2.84 |

| 2 | 2.84 | 2.84 |

| 3 | 2.84 | 2.84 |

| 4 | 2.84 | 2.84 |

| 5 | 2.84 | 2.84 |

| 6 | 2.84 | 2.84 |

| 7 | 2.84 | 2.86 |

| 8 | 3.20 | 2.90 |

| 9 | 3.33 | 2.94 |

| 10 | 3.33 | 2.97 |

*At the end of each year, on a compounded basis.

The application timeline for this particular bond starts on 1 February 2023. Its maturity is in February 2033. Meanwhile, the upcoming payment is on 1 August 2023, and the subsequent payments until maturity are every 6 months on 1 February and 1 August. For the investment amount, the minimum is S$500, and in multiples of S$500.

Source: Monetary Authority of Singapore

So, how do Singapore savings bonds work?

A lot of people think SSBs are too good to be true. If this is the case, you need to fully understand how it works so you can enjoy peace of mind.

When you invest in SSBs, it means you are giving the government full rein into investing your money. You must trust that the government has the capacity to give you your money back.

Generally, bonds are only considered investment-grade once they receive a “BBB” rating by agencies. However, Singapore has had a rating of “AAA” since 2011. Considering this, you’re sure that your money is 100% safe whether you want to wait for your investment to mature or not.

Here’s a summary table to help you understand Singapore Savings Bonds better.

| Eligibility | 18 years old and above |

| Issuer | Government of Singapore |

| Term | Up to 10 years |

| Interest rate |

|

| Investment amount |

|

| Interest payments | Every 6 months after issuance |

| Issuance | New every month |

| Allotment results |

|

| Maturity and redemption |

|

| Tax | Exempt from tax |

| Non-transferrable |

|

How Are Singapore Savings Bonds Different from Singapore Government Securities?

By now, you may be wondering what the difference is between Singapore Savings Bonds (SSB) and Singapore Government Securities (SGS). We’ve compiled this table to give you a clear picture of the differences between these two investment types.

| SSBs | SGS | |

|---|---|---|

| Risk | Lower | Higher |

| Ability to exit before fund matures | Yes | No |

| Investment limit | S$200,000 | None |

| Minimum investment needed | S$500 (per unit) | S$1,000 (per unit) |

When You Should Choose Singapore Savings Bonds over Singapore Fixed Deposits?

Singapore Fixed Deposits and SSBs are two investment instruments that are quite similar because both of them involve a fixed amount of cash pledged for a certain amount of time to gain interest. Moreover, both are considered low-risk investments.

The major difference between the two is the cap on the maximum amount you can earn with SSBs. With fixed deposits, you can invest more money. Many fixed deposits allow you to withdraw money immediately. However, Singapore bonds withdrawal can take up to a week or month. The only difference is that fixed deposits charge a high fee when you withdraw funds prematurely, while SSBs do not.

Considering this, fixed deposits may offer a higher interest especially if you don’t plan on letting your investment mature for 10 years. But if you are working with limited funds, you may not be eligible for fixed deposits, which is why you should consider SSBs.

To help you understand the difference between SSBs and fixed deposits, take a look at this table.

| Singapore Savings Bonds | Fixed Deposits | |

|---|---|---|

| Interest rates | 2.97% (February 2023) | Up to 3.95% |

| Tenure | 10 years | 6, 10, and 12 months |

| Minimum amount | S$500 per bond | S$10,000 |

| Maximum amount | S$200,000 | No limit |

| Early Redemption | No penalty with early redemption. However, you can earn a lower return. | You will need to pay for a penalty fee for premature withdrawal. Moreover, you may earn a pro-rated interest or no interest at all. |

Why Should You Consider Investing in Singapore Savings Bonds?

Here’s why you should consider investing in Singapore Savings Bonds.

Enjoy minimal risk

These savings are 100% backed by the government, which makes it an amazing risk-free option. Whatever the economic status is or if there is a financial crisis, SSBs will continuously give you low risk and high return on investment.

Moreover, it is also a very secure investment instrument. SSBs cannot be tradeable on the open market, which means that their interest rates do not depend on the market such as bonds that rely so much on supply and demand.

Instead, SSBs interest rates are determined through the long-term earnings the Singapore Government Securities generate.

Benefit from flexible exits

People who invest in Singapore bonds are encouraged to wait until their investment matures before they reap its interests. However, you can still enjoy flexible exits and opt-out before the term completes.

Considering this, you can withdraw your money if you encounter an emergency, and the best part is that you’ll receive your money without having to pay any penalty, only a S$2 transaction fee. The same cannot be said for SGS, which needs to be traded at market value.

Usually, your redemption period will take between a week to a month, and your money will be at par value even before maturation. This means that when you withdraw your money, you will be guaranteed the original investment amount, as well as a pro-rated interest based on the time you’ve chosen to withdraw your funds.

Invest supplementary retirement scheme

Since 2018, you can invest in Singapore bonds using your Supplementary Retirement Scheme. This is an incredible way to take advantage of this type of bond because you can gain tax relief for each dollar you contribute to your SRS.

Moreover, you only get a nominal 0.5% interest if you do not invest in your SRS fund. Investing your funds will ensure you’re taking a low amount of risk but still keep liquidity. ‘

Read more: A Comprehensive Guide to CPF in Singapore (2022)

Relatively affordable and tax-free

With this investment instrument, you just need S$500 to get started. This makes it an amazing option for young adults, including students. However, expect not to receive a high return on this small sum because the interests are still lower compared to other forms of riskier investments. Considering this, it’s still a more accessible option compared to other investment instruments that require at least S$10,000 to start. Moreover, Singapore Savings Bonds are tax-free.

High returns compared to savings accounts

Most savings accounts only offer an interest rate of 0.25% per annum, and for those offering a high-interest rate, you would need to have tons of money in the bank first. Meanwhile, Singapore Savings Bond offers a high return on investment compared to savings bonds, which makes it an amazing option for investors.

Receive regular payments

Singapore Savings Bond offers a consistent bi-annual payment. This will help you increase your net worth over the years. If you plan on holding onto your SSBs until it matures, you can plan for big purchases in advance.

Great way to diversify your portfolio

You may have heard of the phrase “don’t put all your eggs in one basket.” Thanks to SSBs, you can diversify your portfolio. SSBs are one of the best ways to spread the risk of your investments because they are safer compared to stocks, and they give you a higher return on investment compared to other bank instruments.

Make you more comfortable trying riskier investments in the future

After you’ve seen your money grow through SSBs, you can be more confident in other types of investments, especially paper assets such as stocks and bonds, as opposed to physical assets. Because you’ve grown your money through SSBs, you will be more driven to try out riskier investments.

Disadvantages of Investing in SSBs

There is no denying that SSBs are extremely helpful for people with low-risk investment appetites. However, it’s not for everyone. Here are some reasons to consider passing on this investment instrument.

Low-interest rate

This is one of the most common reasons why people pass up on SSBs. Years ago, SSB holders could expect up to 3% average return rates per year from this band by the time it matures.

However, the return of the bonds issued this year only ranges from 0.9% to 2.5%. Keep in mind that this is still a more profit-generating option compared to putting your money in banks with a 1% interest rate, but when compared to stocks and ETFs which offer high returns, SSBs pale in comparison.

To help you get a better picture of your potential returns, you can access this page.

High returns only come when SSB matures

While this investment allows you to exit whenever you please, you must consider that the interest you will receive will only get higher as your investment matures at its 10-year mark. This is called step-up interest.

Between the first and 6th year of your investment, expect less than 1% interest rates. This will only increase after you get past the 7th year mark, and even

then, you still shouldn’t expect more than 1.5% interest rates. This may be a deal-breaker for people who don’t like delayed gratification when it comes to investments.

Limited investments

If you’re seeking relatively good investment returns over time, SSB is an awesome option. However, this investment option has a maximum investment limit of S$200,000 per person. Considering this, if you invest S$200,000 this month and you plan on holding your bond for 10 years or until it matures, you will only receive around S$31,400 in returns. You won’t have a chance to get a bigger return compared to other plans.

Varying interest rates per month

The interest rates investors get heavily depend on which month they invest since the government issues a different bond per month. To help give you a clearer picture, SBJUN22 GX22060F by MAS, which is the bond for January 2023, offers an average return of 3.26% over 10 years. Meanwhile, February 2023’s bond only offers an average return of 2.97% over the same period.

Who Can Invest in Singapore Savings Bonds (SSBs)?

Singapore Savings Bonds are not just limited to Singaporeans and Permanent Residents. Even foreigners can invest in it. Thanks to its “AAA” credit rating, the Singapore savings bond is one of the best investment instruments you can invest in.

This makes it perfect for anyone who wants to diversify their portfolio and lower their risks at the same time. It’s also a great option for couples and people who want to grow their finances while still managing risks.

For Singaporeans, PRs, and foreigners who are planning their retirement, SSBs may not be the best option.

Considering this, investing in SSBs still comes down to personal preference, especially because each person has a different risk appetite.

That said, this investment instrument would be suitable for people with lower risk appetites who want a secured return upon investment maturation. If you can handle a high investment risk, the 10-year returns of SSBs may not be enough for you.

Ultimately, it is still not recommended to put all your investments in this instrument due to its relatively low returns compared to riskier investments. However, it can still be helpful if you want to supplement your lifestyle.

How to Purchase Saving Bonds in Singapore?

Applying for Singapore Savings Bonds is easy. Here are the steps you must take.

Step 1: Complete requirements

If you are over 18 years old, register for a CDP Securities account. You must also own a bank account in any of these banks:

- Standard Chartered

- UOB

- POSB/DBS

- Citibank

- Maybank

- OCBC

Step 2: Apply

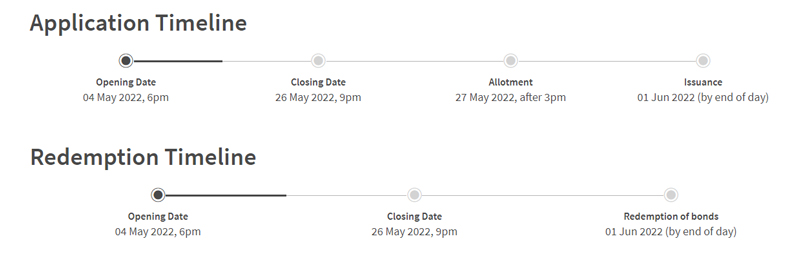

The next step is to apply through internet banking or ATMs listed above. Wait for MAS to announce the amount that is available for issuance, as well as its interest rates. This usually happens on the first business day of the month.

If you prefer to apply via ATM, watch the video below.

For those who want to apply via internet banking, watch the video below.

How to Redeem Your SSBs?

| Redeeming period | What should you do? | What will you receive? |

|---|---|---|

| Early redemption (when there’s schedules interest payment) |

Submit redemption request and pay S$2 transaction fee The channels you can use are:

|

Principal amount and full interest |

| Early redemption (between scheduled interest payments) | Submit redemption request and pay S$2 transaction fee

The channels you can use are:

|

Principal amount and prorated interest |

| Full term |

No fees When your bond matures after 10 years, your principal and the last interest payment will be automatically credited to the bank account linked to your CDP account (for cash applications), or to your SRS account (for SRS applications). |

Principal amount and final interest payment |

Once you have been allotted, you will receive your first interest rate return after 6 months. This can be received through your CDP account, or in your Supplementary Retirement Scheme fund, depending on which one you chose in your application.

Take note that if you redeem your bonds before it matures, you can submit a redemption request in S$500 multiples. It is also possible to redeem more than one bond. This can be done through internet banking or ATMs, and you’ll have to pay a S$2 transaction fee.

Allotment for Oversubscribed Issues

When it comes to Singapore Savings Bond, there are cases when the total applications will exceed the size of the insurance. For these cases, the savings bonds are allocated based on the “quantity ceiling format.”

Quantity ceiling means that each applicant will receive at least S$500 of savings bonds, and this amount will increase for each applicant until all available bonds have been allotted, or until the applicant receives the full amount that applied for.

Considering this, you may not get the full amount you applied for. This is why smaller applications are recommended because it has a higher chance of being fully allotted.

A Word From OMY

Singapore Savings Bonds is undeniably an attractive option for people who have limited funds. With this investment option, you can invest your money and still avoid risks.

With its ease of application and the transparency it offers, Singapore bonds are a standout. Although the interest rates of this investment instrument are not the best, its guaranteed returns still make it worth considering, especially if you want to diversify your portfolio.